If you are searching about Vat & Tax Calculator | PDF | Value Added Tax | Taxes you’ve visit to the right page. We have 1 Pics about Vat & Tax Calculator | PDF | Value Added Tax | Taxes like Vat & Tax Calculator | PDF | Value Added Tax | Taxes and also Vat & Tax Calculator | PDF | Value Added Tax | Taxes. Here it is:

Fundamentally, a tax is a mandatory financial fee or levy placed on a taxpayer – be it an individual or a legal entity like a company – by a governmental organization. The chief purpose of this accumulation is to fund various public expenditures, including infrastructure projects like building bridges and upkeeping highways to essential services like national defense, law enforcement, public health systems, and education. Absent this steady stream of revenue, governments would be unable to provide the services and protections that citizens often depend on and expect as part of a functioning society, essentially underpinning the stability and order we often take for granted.

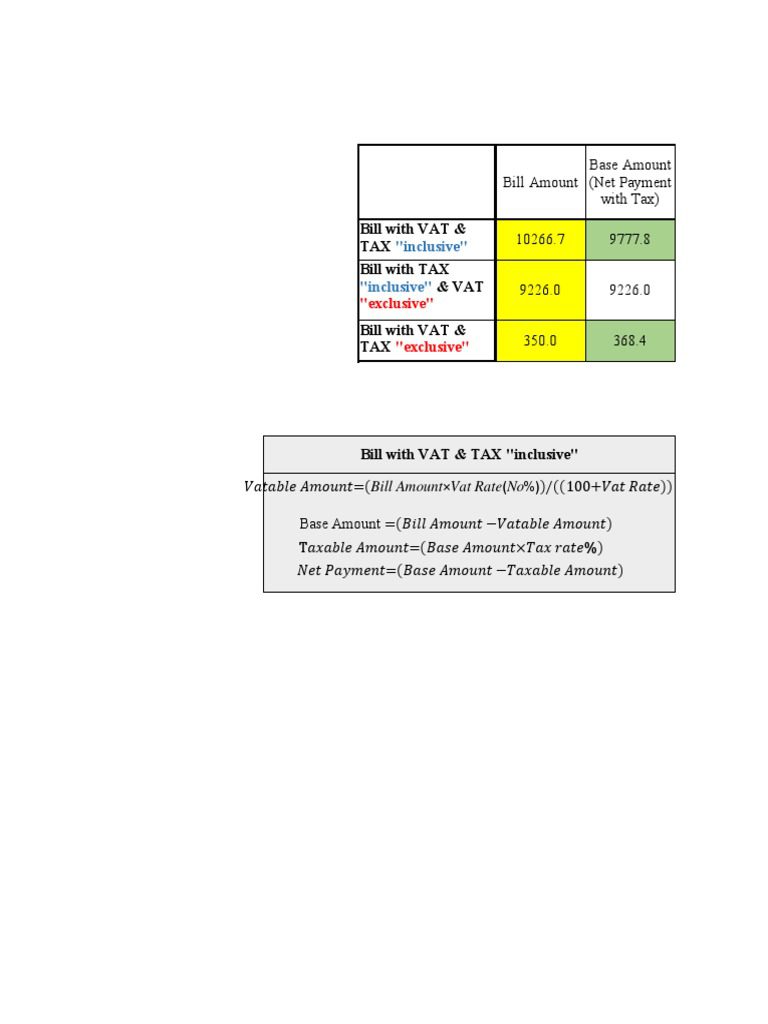

Vat & Tax Calculator | PDF | Value Added Tax | Taxes

www.scribd.com

The existence of taxation is firmly established in the concept of the social contract, an implicit agreement among members of a society to cooperate for social benefits. Citizens contribute a portion of their wealth or income to the state, and in return, the state provides security, order, infrastructure, and services that benefit the collective whole. This system facilitates the pooling of resources to achieve goals and provide services on a scale that would be impossible for individuals or smaller groups to accomplish independently. It embodies a collective investment in the stability, development, and well-being of the community and the nation, uniting individuals together through shared responsibility and benefit.

However, the world of taxation is anything but monolithic or simple. Tax systems differ considerably from one country to another, and even within a single nation, numerous types of taxes exist. These can range from direct taxes levied on income and wealth, for example personal income tax and corporate profit tax, to indirect taxes imposed on goods and services, such as Value Added Tax (VAT) or sales tax. Furthermore, taxes can be levied on property, inheritance, capital gains, and specific activities or products deemed harmful or luxurious. The design of these tax systems, including rates, exemptions, and enforcement mechanisms, demonstrates a complicated interaction of economic goals, political ideologies, and societal values regarding fairness and distribution.

Comprehending the principles and practices of taxation is therefore crucial, not just for economists and policymakers, but for every citizen and business. Taxes impact individual financial decisions, form corporate strategies, drive economic growth (or obstruct it), and support the very structure of our public lives. 1 Debates surrounding tax fairness, efficiency, and its impact on economic behavior are ongoing aspects of political discourse worldwide. Investigating this multifaceted subject reveals much about how societies choose to organize themselves, allocate resources, and pursue collective goals, making it an essential topic for anyone seeking to comprehend the mechanics of the modern economy and government.